In this post, we will talk about the multiple linear

regression using Excel. We will learn about the basic assumptions of classical

linear regression model, performing regression using Excel, and interpreting

the result.

Let’s start with the basic definition of regression analysis.

The term regression was introduced by Francis Galton in

their research paper. Modern interpretation of Regression analysis is concerned

with the study of dependence of one variable (dependent variable), on one or

more other variables (the explanatory or independent variables), with a view of

estimating or predicting the dependent variable’s value in terms of independent

variables.

Method of estimation:

There are two mostly used method of estimation

1-

Ordinary Least Squares (OLS)

2-

Maximum Likelihood (ML)

OLS is highly used method for estimation because it is

intuitive appealing and simpler than ML method. Besides, in linear regression

context the both methods generally give similar results.

Assumptions of OLS

method:

These are the following assumptions of OLS. Under these

assumptions, OLS has some useful statistical properties which makes it one of

the most powerful method of regression analysis. Regression model will be valid

under the following assumptions.

1-

Regression model is linear in parameters, though it may or may not be linear in the

variables i.e. regressand Y and regressor X may be nonlinear.

Yi = β0 + β1 Xi + ui

2-

Fixed regressor X or X values are independent of

the error term

i.e. covariance(Xi ,ui)

= 0

3-

Expected value or mean of error term (random

disturbance) is zero.

E(ui) = 0

4-

Variance of error term (random disturbance) is

same regardless of the value of regressor X. This property is called Homoscedasticity (Home – equal ,

Scedasticity – spread i.e. equal variance)

Var(ui) = σ2

Homoscedasticity refers to the assumption that that the dependent

variable exhibits similar amounts of

variance across the range of values for an independent variable.

Heteroscedasticity is the absence of homoscedasticity.

5-

No

Autocorrelation between the any 2 error terms (random disturbances).

covariance(ui

,uj) = 0 i ≠

j

6-

No Multicollinearity

between the any 2 regressors or X values.

covariance(Xi ,Xj) = 0 i ≠ j

7-

Number of observations must be greater than number

of parameters to be estimated.

For example, we have the data set for a store who sells cold

drinks. We need to find out the relation between the demand of cold drink (dependent variable) and the price of cold drink & advertisement expenses done

(independent variable).

Week

|

Demand (Q)

|

Price (P)

|

Ad

Expenses (A)

|

1

|

51345

|

2.78

|

4280

|

2

|

50337

|

2.35

|

3875

|

3

|

86732

|

3.22

|

12360

|

4

|

118117

|

1.85

|

19250

|

5

|

48024

|

2.65

|

6450

|

6

|

97375

|

2.95

|

8750

|

7

|

75751

|

2.86

|

9600

|

8

|

78797

|

3.35

|

9600

|

9

|

59856

|

3.45

|

9600

|

10

|

23696

|

3.25

|

6250

|

11

|

61385

|

3.21

|

4780

|

12

|

63750

|

3.02

|

6770

|

13

|

60996

|

3.16

|

6325

|

14

|

84276

|

2.95

|

9655

|

15

|

54222

|

2.65

|

10450

|

16

|

58131

|

3.24

|

9750

|

17

|

55398

|

3.55

|

11500

|

18

|

69943

|

3.75

|

8975

|

19

|

79785

|

3.85

|

8975

|

20

|

38892

|

3.76

|

6755

|

21

|

43240

|

3.65

|

5500

|

22

|

52078

|

3.58

|

4365

|

23

|

11321

|

3.78

|

9525

|

24

|

73113

|

3.75

|

18600

|

25

|

79988

|

3.22

|

14450

|

26

|

98311

|

3.42

|

15500

|

27

|

78953

|

2.27

|

21225

|

28

|

52875

|

3.78

|

7580

|

29

|

81263

|

3.95

|

4175

|

30

|

67260

|

3.52

|

4365

|

31

|

83323

|

3.45

|

12250

|

32

|

68322

|

3.92

|

11850

|

33

|

71925

|

4.05

|

14360

|

34

|

29372

|

4.01

|

9540

|

35

|

21710

|

3.68

|

7250

|

36

|

37833

|

3.62

|

4280

|

37

|

41154

|

3.57

|

13800

|

38

|

50925

|

3.65

|

15300

|

39

|

57657

|

3.89

|

5250

|

40

|

52036

|

3.86

|

7650

|

41

|

58677

|

3.95

|

6650

|

42

|

73902

|

3.91

|

9850

|

43

|

55327

|

3.88

|

8350

|

44

|

16262

|

4.12

|

10250

|

45

|

38348

|

3.94

|

16450

|

46

|

29810

|

4.15

|

13200

|

47

|

69613

|

4.12

|

14600

|

48

|

45822

|

4.16

|

13250

|

49

|

43207

|

4

|

18450

|

50

|

81998

|

3.93

|

16500

|

51

|

46756

|

3.89

|

6500

|

52

|

34593

|

3.83

|

5650

|

Performing multiple

regression in Excel

1-

Click on the data tab. Then click on the menu Data Analysis at the corner. Then a pop up window will open. Now

select Regression from this pop up

window. And click in OK.

2-

Now a pop up window will open asking for inputs.

Now click on arrow sign to select the X range (Regressor) and Y range.

3-

You can select any of the parameters like

confidence interval (by default it is 95%) or any other as per your requirement.

4-

Now select the output range. You have options to

get output in same work sheet, new worksheet and new workbook. Here we want to

get output in same worksheet and selected a range. As you can see in above pic.

Now press OK to get output.

Interpretation of

regression output:

Regression Statistics

table:

Multiple R – is the

coefficient of multiple correlation. You may be knowing the bivariate

correlation. Multiple correlation can be interpreted in the same way. R is a measure of the strength of the association

between the independent variables and the one dependent variable.

R Square – is the

square of Multiple R. It is called as multiple coefficient of determination. It is useful to explain that how much

of total variation can be explained by the predicted model. It is measure of

goodness of fit of predicted model.

In our case R square = 0.263782. It means that 26.37% of the

variation (variation of Y around its mean) can be explained by the model (by

independent variables).

Unfortunately, in case of multiple regression R square is

not the unbiased estimation of coefficient of determination. Adjusted R square is

a better estimate for coefficient of determination in case of multiple

regression.

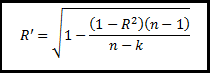

Adjusted R Square -

It indicates that how much of total variation can be explained by the model,

adjusted for the degree of freedom. It should be used in place of R square for

multiple regression

Where k = the number of variables in the

model (Independent as well as dependent) and n = the number of data elements in the

sample.

In our case, k=3 (2 IV, and

1DV) , and n =52

Standard Error - refers to the estimated

standard deviation of the error term u. Sometimes it is called as standard

error of the regression.

Standard

Error = sqrt(Square sum of error ∕(n-k))

ANOVA Table:

Sum Squares (SS) corresponding to regression is called Explained Sum Square (ESS) or Sum

Square Regression (SSR).

Sum Squares (SS) corresponding to residual is called Residual Sum Square (RSS) or Sum

Square Error (SSE).

Total Sum Square (TSS) = ESS + RSS

Mean Sum Square = SS/df

Significance of F – indicates weather value of R square is significant or not i.e. significance

of measure of goodness of fit.

Coefficients - gives the least squares estimates of βj.

Standard

error- gives the

standard errors of the least squares estimates bj of βj.

t Stat- gives the

computed t-statistic for hypotheses H0: βj = 0 against Ha: βj ≠

0. It checks for the significance of the parameter βj values. Also

called as significance test.

T stat = Coefficients / Standard error.

It is compared to a t value from t-table with df degrees of freedom and a

particular confidence interval (1-α).

P-value- gives the p-value for test of H0: βj =

0 against Ha: βj ≠ 0. It is the testing of hypotheses.

As we have taken a confidence interval of 95%. So, if p-value corresponding to a parameter is less

than 0.05. Then, we will reject the Null Hypothesis i.e. βj ≠ 0

or is significant.

Note that this p-value is for a

two-sided test. For a one-sided test divide this p-value by 2 (also checking

the sign of the t-Stat).

Columns Lower 95% and Upper 95% values define a 95% confidence interval for βj.

Estimated Regression Model:

Estimated Industry Demand (Q

cap) = 100626.034 -16392.63 * Price (P) + 1.5763295 * Ad Expense (A)

No comments:

Post a Comment