In this post, we will discuss about the different rotation

methods available in SPSS, and use each of method.

We will start with the definition of rotation and usefulness

of rotation in factor and principal component analysis.

According to Yaremko, Harari, Harrison, and Lynn, factor

rotation is as follows:

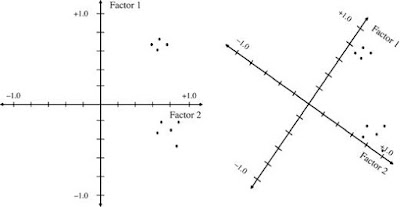

“In factor or principal-components analysis, rotation of the

factor axes (dimensions) identified in the initial extraction of factors, in

order to obtain simple and interpretable factors.”

Types of Rotation: There are 2 types of rotations.

1- Orthogonal Rotation: These methods assumes that the factors or components

in analysis are uncorrelated.

a. Varimax Method: minimizes the number

of variables that have high loadings on each factor. This method simplifies

the interpretation of the factors.

b. Quartimax Method: minimizes

the number of factors needed to explain

each variable. This method simplifies the interpretation of the observed

variables.

c. Equamax Method: combination of the varimax method, which simplifies

the factors, and the quartimax method, which simplifies the variables. The

number of variables that load highly on a factor and the number of factors

needed to explain a variable are minimized.

2- Oblique Rotation: SPSS has two oblique

rotation methods.

a. Direct oblimin Method

b. Promax Method: can be calculated more quickly than a

direct oblimin rotation, so it is useful for large datasets.

Decision to choose a

rotation method:

Tabachnick and Fiddell argue that “Perhaps the best way to

decide between orthogonal and oblique rotation is to request oblique rotation

[e.g., direct oblimin or promax from SPSS] with the desired number of factors and

look at the correlations among factor. If factor correlations are not driven by

the data, the solution remains nearly orthogonal. Look at the factor

correlation matrix for correlations around .32 and above. If correlations

exceed .32, then there is 10% (or more) overlap in variance among factors,

enough variance to warrant oblique rotation unless there are compelling reasons

for orthogonal rotation.”

Moreover, as Kim and Mueller put it, “Even the issue of

whether factors are correlated or not may not make much difference in the

exploratory stages of analysis. It even can be argued that employing a method

of orthogonal rotation (or maintaining the arbitrary imposition that the

factors remain orthogonal) may be preferred over oblique rotation, if for no

other reason than that the former is much simpler to understand and interpret.”

We can think of the goal of rotation and of choosing a

particular type of rotation as seeking something called simple structure.

Bryant and Yarnold define simple structure as:

A condition in which variables load at near 1 (in absolute

value) or at near 0 on an eigenvector (factor). Variables that load near 1 are

clearly important in the interpretation of the factor, and variables that load

near 0 are clearly unimportant. Simple structure thus simplifies the task of

interpreting the factors.

Thurstone’s 5 criteria

to choose a rotation method:

Thurstone first proposed and argued for five criteria that

needed to be met for simple structure to be achieved:

1-

Each variable should produce at least one zero

loading on some factor.

2-

Each

factor should have at least as many zero loadings as there are factors.

3-

Each pair of factors should have variables with

significant loadings on one and zero loadings on the other.

4-

Each pair of factors should have a large

proportion of zero loadings on both factors (if there are say four or more

factors total).

5-

Each pair of factors should have only a few

complex variables.

Zero loading- One

rule of thumb is that zero loadings includes any that fall between -.10 and

+.10.

Significant loading-

With a sample size of say 100 participants, loadings of .30 or higher can be considered

significant, or at least salient. With much larger samples, even smaller

loadings could be considered salient, but in language research, researchers

typically take note of loadings of .30 or higher.

Complex variables-

Variables with loadings of .30 or higher on more than one factor